2023 Year-End Letter

Dear Clients and Friends,

The stock market is a funny thing. It’s that fanatical friend you have that sees no gray, only adoration or disdain. This friend has a way of extrapolating everything to the extreme. When their favorite baseball team scores in the first inning on opening day, “World Series here we come!”. By May their team falls a game back in their division, “Fire the Coach!”. In this way, many stocks spend considerable time being either hounded for autographs or walking to the plate in a sea “Boo!”.

Ask any pro, however, and they’ll tell you to focus on the process. In investing, as in baseball, results can be highly random. According to Fangraphs, a line drive (the most successful way to hit a baseball) still results in an out approximately 31.5% of the time. Ground balls are considered the least desirable form of contact, but still result in a hit 23.9% of the time. Sometimes you will be penalized for good contact and rewarded for poor contact. As a result, it is more useful to focus on your process. Did you swing at the pitches you could hit for a line drive? Did you pass on those you couldn’t?

The same is true with investing. In 2022, our portfolios had a banner year (relative to the stock market). At the start of the year, I wrote about the problems with overvaluation in large swathes of the market. While the stock market carnage that ensued was precisely what I feared, it was merely a coincidence that it occurred so quickly. Once interest rates rose and fears of an economic slowdown emerged our fanatical friend incited a chorus of boos upon prior stock market darlings. We, of course, owned stocks that didn’t previously receive such praise and thus were spared from the scorn. While some of those previous darlings were not worthy of a roster spot (I’m looking at you Peloton), many were not so bad (META as an example). 2023 when then the year of AI and the “Magnificent Seven” which carried the market higher. While our portfolios were largely immune to the disaster of 2022, they didn’t really participate in 2023. In many ways, we find ourselves in a similar situation to the start of 2022.

Let’s cut to the chase. I hold the vast majority of my liquid net worth in our stock portfolios. I was relieved to avoid the losses of 2022, but annoyed at missing the gains of 2023. It was the worst result we’ve had over the course of my tenure. Was that a success or failure in terms of process? In other words, did we execute on what we need to do to be successful in the long run? Our process involves selecting portfolios of stocks with sustainable competitive advantages with management teams incentivized to act in our best interests. And lastly, to purchase those at significant discounts to their fair value. This process has, on average, served our clients well. I would say 2022 is best illustrated with making contact and then watching the defense throw the ball in the stands. We did our job, but we only ended up on second base because our opponents screwed up.

In the aftermath of 2022, my team combed through the rubble but very little fit our criteria. For example, I mentioned META (Facebook, Instagram). META lost 64.22% in 2022 (according to FactSet) and trading at cheap multiples of earnings and cash flow while sporting a considerable advantage in social media. Why didn’t that make it into the portfolio? After all, META returned 194.13% to investors in 2023. Was this a whiff? It may appear so, but the company fails on a key criterion. Founder Mark Zuckerberg holds a special class of shares that give him extra votes meaning he controls the company without owning a majority stake. At the time, he was leveraging that control to spend many billions on metaverse worlds that amounted to shoveling investor cash in an incinerator. He ultimately changed tack, but this was not a situation with which I felt comfortable entrusting our hard-earned dollars. Without that trust, I cannot make rational and clear-headed investment decisions. That’s the process. In addition, I find it difficult to project how long their competitive advantage will last. Competitors like TikTok can seemingly emerge overnight. The best characterization of 2023? That was a pitch at which I shouldn’t swing, and the call didn’t go my way. I don’t like the latest result, but I would make the decision again if given the chance.

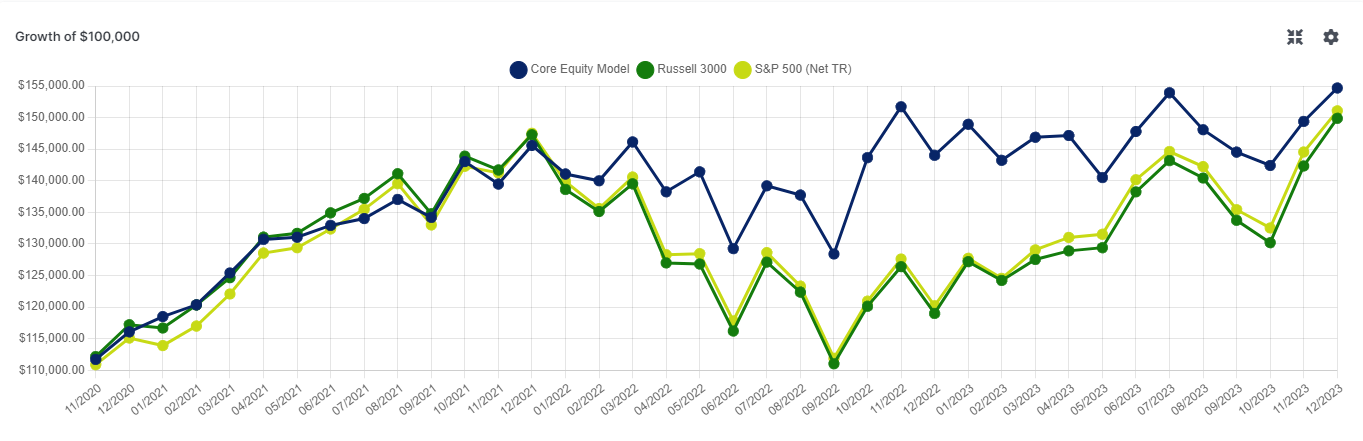

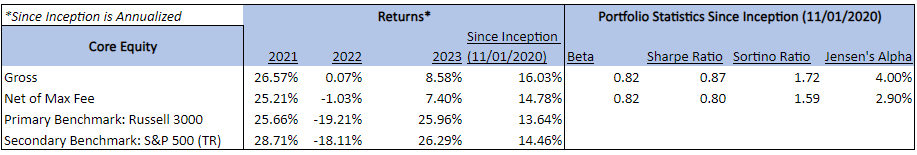

Core Equity

The Core Equity Portfolio has put up strong results since we started it in November of 2020, It has outperformed the benchmark with notably lower market risk (0.82 Beta) and attractive downside protection (1.59 Sortino on the maximum fee). However, 2023 proved challenging for our investment style.

We own few technology stocks (CheckPoint, Microsoft, Morningstar). While those stocks performed well, they represent just under 11% of the portfolio. Our energy stocks went from a tailwind in 2023, a headwind for performance with both Coterra and Exxon lagging the broader market. Our largest winners outside of tech were Fastenal, JPMorgan, and Simon. All three are in industries with current challenges but their superior business models allow them to thrive. Our worst performer was Sibanye Stillwater which suffered from declining commodity prices and electrical grid problems in South Africa. We believe the worst of those issues are in the rearview mirror and added to the stock over the course of 2023. Aside from adding or subtracting to our existing holdings we did exit one stock in 2023. We sold Axon back in May, assessing the stock as too expensive.

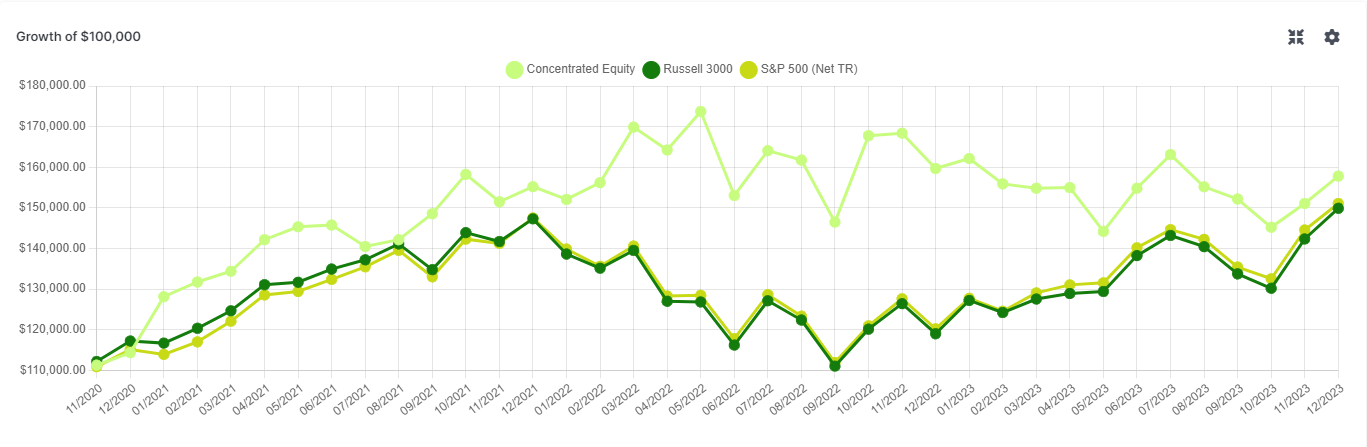

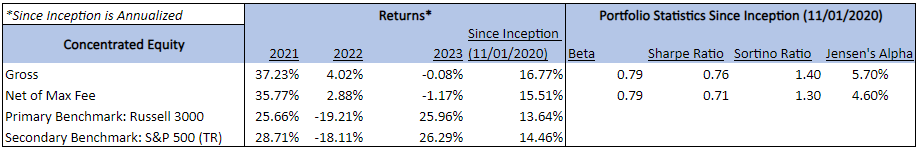

Concentrated Equity

The Concentrated Equity Portfolio has been successful since launch November of 2020, but with greater variation in results in comparison to our Core offering due to having fewer stocks in fewer industries. Since inception, this portfolio has achieved that performance with less market risk (0.79 Beta) while protecting on the downside (1.30 Sortino at Maximum Fee Levels).

This portfolio has outsized positions in commodities (Exxon, Coterra, Sibanye) and financials (Diamond Hill and Webster Financial). Sibanye had a disappointing year as platinum and palladium prices declined while their South African mines suffered from electrical grid issues. We believe those problems are not likely to get worse and that the valuation is attractive so we added to the position throughout the year. Our best performer was Lovesac, which we also added to during the year. We bought no new stocks during the year, but we did sell our remaining shares of Gentex to enhance our positions in other holdings.

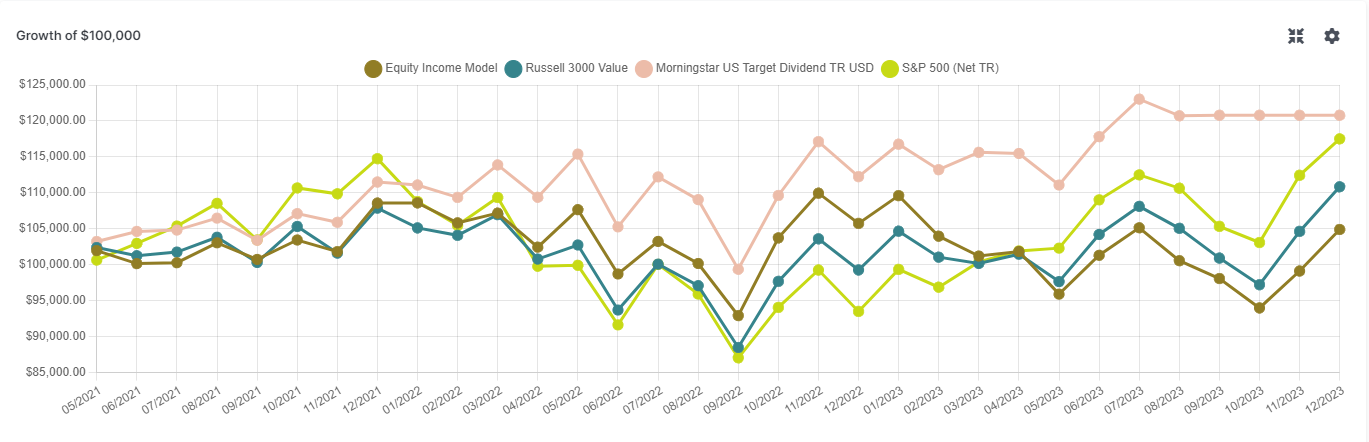

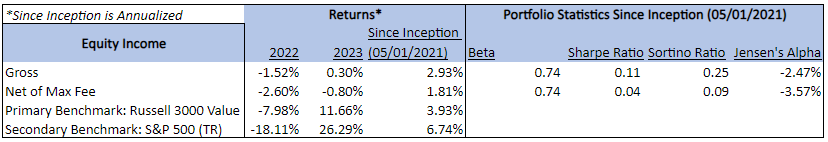

Equity Income

The Equity Income Portfolio has lagged its benchmarks since inception in May of 2021. However, the primary goal for this strategy is to produce a high and growing stream of dividend income. In this regard, the portfolio has largely succeeded. The portfolio has exhibited low levels of risk compared to the market (0.74 Beta) but the dividend mandate has hindered its ability to keep up with the market in terms of total return. Excluding special dividends, the estimated dividend yield of the portfolio was 4.72% as of the end of 2023.

One of the key contributors to underperformance is the lack of technology exposure. Few technology firms have a high enough dividend yield to warrant consideration so our performance relative to the market is significantly impacted by strength or weakness in technology shares. Our best performing stocks were Artisan Partners and Simon Property Group. Our largest detractors were Sibanye (lower commodity prices and electrical grid problems) and Pfizer (lower covid19 vaccine sales).

On the whole, we are happy to report that most of our holdings have been raising their dividends. So long as their business continues to grow that should eventually be reflected in total returns. A handful pay variable dividends and fluctuate from year to year. Sibanye was our lone holding that cut their regular dividend. Assuming the dividend is not restored, we will look to trade out of that stock at more favorable prices in exchange for an attractive dividend. In 2023, we made only a handful of transactions. We trimmed our position in Pepsi to increase the holdings of AT&T and Sibanye. While we don’t aim to buy and sell frequently in this (or any other portfolio), it is likely that we will be relatively more active in the year ahead as we look to adjust the portfolio.

Invest Curiously,

Austin

Austin Crites, CFA

Chief Investment Officer

Aurora Asset Management/Aurora Financial Strategies

Definitions from Investopedia

Beta - Beta is a measure of a stock's volatility in relation to the overall market.

Sharpe Ratio -The Sharpe ratio compares the return of an investment with its risk.

Sortino Ratio - The Sortino ratio is a variation of the Sharpe ratio that differentiates harmful volatility from total overall volatility by using the asset's standard deviation of negative portfolio returns—downside deviation—instead of the total standard deviation of portfolio returns.

Jensen's Alpha - The Jensen's measure, or Jensen's alpha, is a risk-adjusted performance measure that represents the average return on a portfolio or investment, above or below that predicted by the capital asset pricing model (CAPM), given the portfolio's or investment's beta and the average market return. This metric is also commonly referred to as simply alpha.

Austin Crites is the Chief Investment Officer of Aurora Asset Management, an Indianapolis-based subsidiary of Aurora Financial Strategies which is located in Kokomo, IN. He can be reached via email at austin@auroramgt.com. Investment Advisory Services are offered through BCGM Wealth Management, LLC, a SEC registered investment adviser. Registration with the United States Securities and Exchange Commission does not imply that BCGM or any of its principals or employees possesses a particular level of skill or training in the investment advisory business or any other business. This blog does not constitute advice. This is not an offer to buy or sell securities. Advisor is not licensed in all states. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. BCGM Wealth Management, LLC manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results. Clients may own positions in the securities discussed.

Concentrated Equity Factsheet Disclosure

Past performance is not indicative of future returns. Performance for periods of one year or less is not annualized. Additionally the performance results displayed herein may have been adversely or favorably impacted by events and economic conditions that will not prevail in the future. The composite portfolio that generated the historic returns differs from the current portfolio, and the portfolio composition may also change in the future, at the discretion of BCGM. Results of the composites presented herein do not reflect the results of any one portfolio in the composite. For the Concentrated Equity composite, the minimum asset level is $25,000. Prior to January 1, 2023, the composite is inclusive of assets subscribed to the Concentrated Equity model that were below the stated minimum. For all timeframes, only assets subscribed to and managed in the Concentrated Equity model are eligible for composite inclusion. The Concentrated Equity composite is comprised of assets subscribed to and managed in the Concentrated Equity model. The Concentrated Equity model is a highly concentrated, all-cap strategy invested primarily in U.S. domiciled companies and stocks of foreign firms with ADRs. The composite inception date is 11/01/2020. New accounts and/or new sleeve assets are eligible for inclusion in their first full month of being funded and invested in the model. Closed accounts and/or closed sleeves are included through their last full month of being funded and invested in the model. Accounts and/or sleeves that have experienced a cash inflow or outflow of 10% or more of the accounts/sleeves starting or ending value during a month are excluded. Accounts/sleeves with performance that deviates the composite by +/- 2 standard deviations are excluded from the composite for the period(s) in which the deviation(s) occurred. All accounts with investment restrictions have been excluded from the composite. Gross performance is calculated by subtracting the actual transaction costs from the composite performance. Net performance is calculated using the maximum advisory fee for the Concentrated Equity model, which is 1.10%. The Concentrated Equity model generally does not automatically reinvest dividends. For reasons including changes in portfolio holdings, and the date on which an individual became an investor in one of the portfolios, the performance experienced by a specific investor may vary substantially from that indicated in the performance results.

Market index information, where included, is to show relative market performance for the periods indicated and not as standards of comparison, since these are unmanaged, broadly based indices that differ in numerous respects from the composition of BCGM’s portfolios. Market indices are not available for direct investment. The historical performance results of the presented indices do not reflect the deduction of transaction and custodial charges, or the deduction of an investment management fee, the incurrence of which would decrease indicated historical performance. The historical benchmark performance results are provided for comparison purposes only, to assist an investor in determining whether an investment program meets his/her investment objective(s). Market index information was compiled from sources that BCGM believes to be reliable, however, BCGM makes no representations or guarantees hereby with respect to the accuracy or completeness of such data. The S&P 500 is a stock market index tracking the stock performance of 500 of the largest companies listed on stock exchanges in the United States. The Russell 3000 Index is a market-capitalization-weighted equity index maintained by FTSE Russell that provides exposure to the entire U.S. stock market. The index tracks the performance of the 3,000 largest U.S.-traded stocks, which represent about 97% of all U.S.-incorporated equity securities.

Core Equity Factsheet Disclosure

Past performance is not indicative of future returns. Performance for periods of one year or less is not annualized. Additionally the performance results displayed herein may have been adversely or favorably impacted by events and economic conditions that will not prevail in the future. The composite portfolio that generated the historic returns differs from the current portfolio, and the portfolio composition may also change in the future, at the discretion of BCGM. Results of the composites presented herein do not reflect the results of any one portfolio in the composite. For the Core Equity composite, the minimum asset level for inclusion is $50,000. Prior to January 1, 2023, the composite is inclusive of assets subscribed to the Core Equity model that were below the stated minimum. For all timeframes, only assets subscribed to and managed in the Core Equity model are eligible for composite inclusion. The Core Equity model is an all-cap strategy invested primarily in stocks of U.S. domiciled companies and stocks of foreign firms with ADRs. The composite inception date is 11/01/2020. New accounts and/or new sleeve assets are eligible for inclusion in their first full month of being funded and invested in the model. Closed accounts and/or closed sleeves are included through their last full month of being funded and invested in the model. Accounts and/or sleeves that have experienced a cash inflow or outflow of 10% or more of the accounts/sleeves starting or ending value during a month are excluded. Accounts/sleeves with performance that deviates the composite by +/- 2 standard deviations are excluded from the composite for the period(s) in which the deviation(s) occurred. All accounts with investment restrictions have been excluded from the composite. Gross performance is calculated by subtracting the actual transaction costs from the composite performance. Accounts/ sleeves with performance that deviates the composite by +/- 2 standard deviations are reviewed for potential exclusion for the period(s) in which the deviation(s) occurred. The Core Equity model generally does not automatically reinvest dividends. For reasons including changes in portfolio holdings, and the date on which an individual became an investor in one of the portfolios, the performance experienced by a specific investor may vary substantially from that indicated in the performance results.

Market index information, where included, is to show relative market performance for the periods indicated and not as standards of comparison, since these are unmanaged, broadly based indices that differ in numerous respects from the composition of BCGM’s portfolios. Market indices are not available for direct investment. The historical performance results of the presented indices do not reflect the deduction of transaction and custodial charges, or the deduction of an investment management fee, the incurrence of which would decrease indicated historical performance. The historical benchmark performance results are provided for comparison purposes only, to assist an investor in determining whether an investment program meets his/her investment objective(s). Market index information was compiled from sources that BCGM believes to be reliable, however, BCGM makes no representations or guarantees hereby with respect to the accuracy or completeness of such data. The S&P 500 is a stock market index tracking the stock performance of 500 of the largest companies listed on stock exchanges in the United States. The Russell 3000 Index is a market-capitalization-weighted equity index maintained by FTSE Russell that provides exposure to the entire U.S. stock market. The index tracks the performance of the 3,000 largest U.S.-traded stocks, which represent about 97% of all U.S.-incorporated equity securities.

Equity Income Factsheet Disclosure

Past performance is not indicative of future returns. Performance for periods of one year or less is not annualized. Additionally the performance results displayed herein may have been adversely or favorably impacted by events and economic conditions that will not prevail in the future. The composite portfolio that generated the historic returns differs from the current portfolio, and the portfolio composition may also change in the future, at the discretion of BCGM. Results of the composites presented herein do not reflect the results of any one portfolio in the composite. For the Equity Income composite, the minimum asset level for inclusion is $50,000. Prior to January 1, 2023, the composite is inclusive of assets subscribed to the Equity Income model that were below the stated minimum. For all timeframes, only assets subscribed to and managed in the Core Equity model are eligible for composite inclusion. The Equity Income composite is comprised of assets subscribed to and managed in the Equity Income model. The Equity Income model is an all-cap strategy invested primarily in dividend-paying stocks of U.S. domiciled companies and stocks of foreign firms with ADRs. The composite inception date is 05/01/2021. New accounts and/or new sleeve assets are eligible for inclusion in their first full month of being funded and invested in the model. Closed accounts and/or closed sleeves are included through their last full month of being funded and invested in the model. Accounts and/or sleeves that have experienced a cash inflow or outflow of 10% or more of the accounts/sleeves starting or ending value during a month are excluded. Accounts/sleeves with performance that deviates the composite by +/- 2 standard deviations are excluded from the composite for the period(s) in which the deviation(s) occurred. All accounts with investment restrictions have been excluded from the composite. Gross performance is calculated by subtracting the actual transaction costs from the composite performance. Net performance is calculated using the maximum advisory fee for the Equity Income model, which is 1.10%. The Equity Income model generally does not automatically reinvest dividends. For reasons including changes in portfolio holdings, and the date on which an individual became an investor in one of the portfolios, the performance experienced by a specific investor may vary substantially from that indicated in the performance results.

Market index information, where included, is to show relative market performance for the periods indicated and not as standards of comparison, since these are unmanaged, broadly based indices that differ in numerous respects from the composition of BCGM’s portfolios. Market indices are not available for direct investment. The historical performance results of the presented indices do not reflect the deduction of transaction and custodial charges, or the deduction of an investment management fee, the incurrence of which would decrease indicated historical performance. The historical benchmark performance results are provided for comparison purposes only, to assist an investor in determining whether an investment program meets his/her investment objective(s). Market index information was compiled from sources that BCGM believes to be reliable, however, BCGM makes no representations or guarantees hereby with respect to the accuracy or completeness of such data. The S&P 500 is a stock market index tracking the stock performance of 500 of the largest companies listed on stock exchanges in the United States. The Russell 3000 Index is a market-capitalization-weighted equity index maintained by FTSE Russell that provides exposure to the entire U.S. stock market. The index tracks the performance of the 3,000 largest U.S.-traded stocks, which represent about 97% of all U.S.-incorporated equity securities. The Morningstar US Target Dividend TR USD Index reflects the performance of 50 dividend-paying U.S. based equities screened for quality and financial health.