Groceries Gone Digital: Instacart IPO, Who Wins? Who Loses?

Once upon a pre-Covid time, the idea of online grocery was quite niche constituting just 3% of all grocery sales in 2019. Fast forward to September 2023, the time of the multi-billion dollar IPO of Instacart whose primary business is sending gig workers to grocery stores as a sort of personal shopper and delivering them to customer doorsteps. In 2022, approximately 12% of grocery sales in the US were online which includes both pickup and delivery. The pandemic pulled forward this trend in groceries that we have seen in everything from books to apparel, a gradual shift to digital channels. With so much change afoot, it begs the question: Who wins? Who loses?

Why are People Buying Groceries Online?

While pandemic concerns were a catalyst in introducing Americans to the idea of digital grocery, other reasons will shift more grocery sales online over time. The primary concern most shoppers have with this model is the desire to inspect their food prior to purchase. They want to select their produce for ideal size and ripeness, and they want to see the marbling on their steak. Though I do the bulk of my grocery shopping online, I still want to pick the perfect steak before it hits my grill.

So, what are the benefits?

Time – As a business owner and a parent to young children, time is quite scarce. I estimate that having my groceries delivered saves me approximately 100 hours per year.

Planning – I get deliveries about twice per week, so I only need to plan meals a few days in advance rather than the entire week when I shopped every weekend. It’s also much easier to plan your grocery list. When I’m running low on eggs, I can simply scan the carton to add it to the cart.

Savings and Food Waste – I noticed a significant decrease in food waste and cost savings switching to digital shopping. No more impulse buys at the aisle endcaps. And because I’m scheduling deliveries every few days, I always have fresh produce.

USA Grocery Delivery Market Growth is Expected to Continue

The Landscape

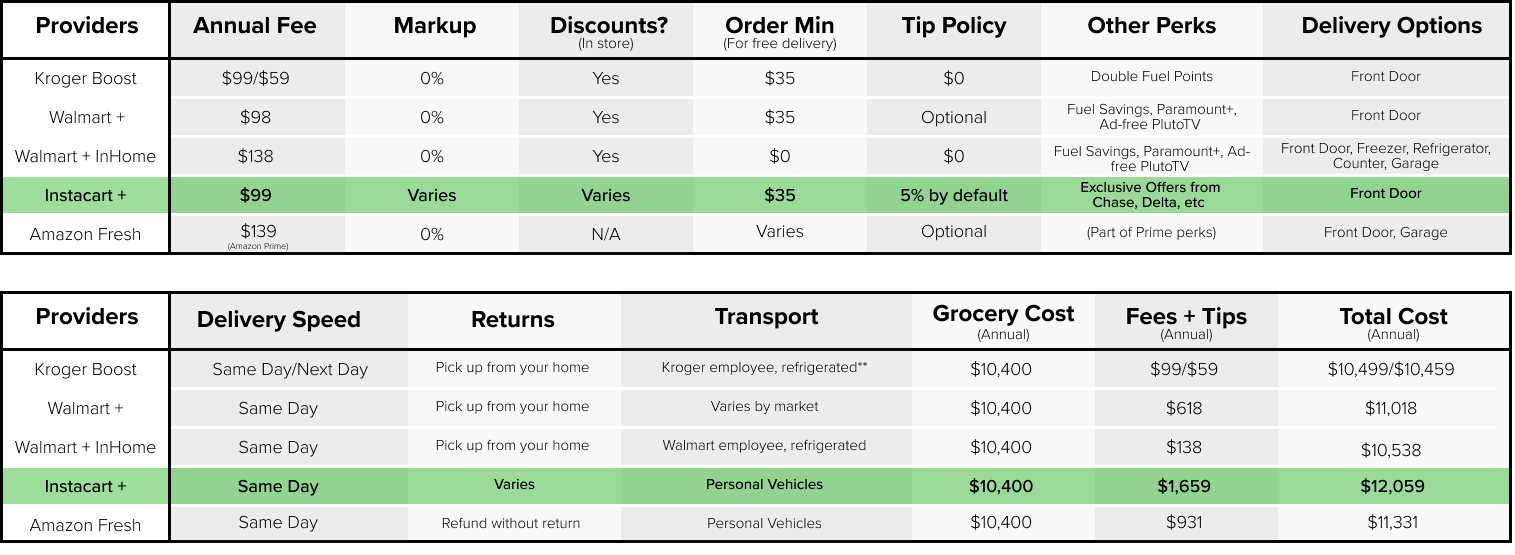

Consumers have several choices, but companies are competing around a few key priorities with annual subscription plans. The offerings tend to be differentiated around speed, convenience in delivery options, mode of transport, and overall cost. This is not an exhaustive list and some may not be available in your area, but below are the main options.

*A note on Cost: I have estimated the annual cost in this table assuming two deliveries per week at $100 per order (excluding fees, markups, tips). Where tips apply, I have assumed 5% gratuity and while it varies by retailer and item, I have assumed a 10% markup on Instacart.

**Kroger Boost: Same day delivery through Kroger Boost is performed by Instacart drivers so the refrigerated vehicle is not an option and you will need to tip the Instacart driver. You do, however, still get free delivery and the Kroger Plus discounts and coupons.

***Amazon Fresh: Assumed $3.95 delivery fee. All delivery orders from Whole Foods carry a $9.95 delivery fee. Delivery orders from Amazon Fresh are free over $150 for Prime members. The Amazon Fresh delivery fee is $3.95 for orders $100-150, $6.95 for $50-100, and $9.95 for under $50.

Overview by Company

Kroger

Kroger is competing through an extension of their “Fresh” strategy by using refrigerated vehicles to perform their deliveries. The strategy is differentiated in how they fulfill these orders. Kroger is using a hub and spoke model of automated fulfillment centers in partnership with Ocado. Kroger employees pick up over 20 deliveries at a time in a refrigerated truck on pre-planned routes. This model should allow for profitability that is on par with in-store sales or better and ensure that they control the customer experience. The main drawback here is speed. Customer surveys show a strong preference for same-day delivery. Because Kroger is eating Instacart’s fee (aside from driver tip), they will be reliant on consumers willingness to schedule deliveries a day in advance for this model to create value for investors. It remains to be seen whether customers will forgo speed in return for cost savings and a refrigerated trip to their home at a high enough rate for Kroger to build the necessary route density. Kroger is the only competitor that is using extensive automation and route efficiency to drastically reduce human labor in grocery delivery rather than merely customer shopping and driving hours onto someone else.

WalMart

WalMart is competing mainly on speed and convenience. WalMart uses their store network as fulfillment centers with employees and Spark contractors building customer baskets off store shelves and delivering it to homes. While I have concerns about whether this model can be profitable on its own, I suspect WalMart is thinking about grocery delivery as a piece of the overall customer relationship. The WalMart+ InHome (where it is available) appears to be the best value out there. It comes with a higher annual fee, but it is the only option out there that allows for no order minimums for free delivery. It is also the only service I examined that will place your items in your kitchen.

Instacart

The irony of Instacart is that although roughly 75% of its revenue comes from grocery delivery, going directly through Instacart is the most expensive way for a consumer to enter that transaction. Instacart works by aggregating an army of gig workers to perform as personal shoppers and delivery people with a focus on speed of service. However, because they are merely a service provider to the industry, they get compensated through an upcharge on every item typically ranging from 10-30% and rely on the consumer to pay the gig workers it is the least economical business model. The primary motivation for signing up with Instacart is that a consumer is not locked into one retailer. Still, Instacart has only produced a profit in one of the past three years. I expect Instacart to be forced to lower pricing as competition heats up with fellow gig economy companies like Uber and DoorDash (see chart below).

Amazon

Amazon Fresh is popular with Amazon Prime members since it is an included benefit of the subscription. They utilize gig workers to make grocery deliveries. Apart from being top of mind with Prime users, it is not a competitive option unless grocery delivery except for customers that use it infrequently. The minimum order for free delivery for Amazon Fresh is quite high at $150 and no such free tier is available at Whole Foods. Prime members also void their in-store discount by choosing delivery. Amazon has struggled in grocery since their acquisition of Whole Foods, but this service will likely remain popular with loyal customers. They do have the most favorable return policy, providing a refund without a requirement to return the goods. Amazon likely views this as a complementary service to retain high spending Prime members.

Economic Moats and Market Share in Digital Grocery

There will be economic moats (sustainable competitive advantages) built in digital grocery. Incumbent grocers will leverage their existing assets to compete for digital business while the relatively new entrants from the technology sector do the same. The end result is a bit convoluted, but in general digital grocery will benefit scale not unlike the traditional grocery business but with some new twists. I expect market share in delivery to be more concentrated than the traditional grocery business. Regional grocers will lose out due to lack of resources to spend on technology and lower bargaining power with consumer package goods companies and delivery partners. Digital only competitors (Instacart, Uber, DoorDash, etc.) will retain much of the delivery portion (especially same-day) but will struggle to turn a profit with little to differentiate providers other than price. The companies best positioned to build a moat in grocery delivery are those with scale, existing store networks, self-manufactured private label, technology assets and volumes of customer data. Let’s explore some specific moat building concepts.

Intangible Assets

Intangible assets will be an important aspect of moat-building in digital grocery. The company brand and reputation are important in traditional grocery, and become even more so in digital. Without the ability to inspect food prior to purchase, consumer trust becomes even more important. More unique to digital is the intellectual property regarding technology and automation. Consumers expect a slick interface and easy to use app. In addition, WalMart and Amazon’s internal supply chain automation capabilities will be useful. Kroger’s exclusive US partnership with Ocado is unique here as it’s automated fulfillment centers are designed specifically for grocery. Another asset is customer data which becomes ever more valuable in digital grocery. Each of the large competitors excel in this area. In traditional grocery, CPG firms negotiate for shelf space and placement. In digital, the shelf becomes smaller (similar to Amazon marketplace or a Google search). In theory, the app could offer hundreds of options in a search but the customer will likely choose from an item on the first page providing an opportunity for ad sales.

Cost Advantage

Cost advantages will come in many forms and many have a higher interaction with intangible assets. In order for a digital grocer to maximize the ad sales opportunity, they need both customer data and strong leverage. One form of leverage is in the form of self-manufactured private label. The edge here goes to WalMart and Kroger. They earn significantly higher margins on these self manufactured private label products and as a result can use them as the default product at the top of the search results (absent adequate ad sales) much in the same way as Amazon uses Amazon Basics in their search results. Kroger is developing a cost-advantage moat in next day delivery through the buildout of automated fulfillment centers and route density with trucks holding over 20 orders compared to the 1-3 that might be on offer for the typical Instacart driver. Scale also has benefits in negotiations with CPG firms. Your favorite brand of chips or cookies is going to need to offer better terms to WalMart than anyone else for premium shelf and search query placement. Store assets are another advantage. WalMart can use their stores as fulfillment centers in part because of their proximity to consumers, providing a speed advantage in delivery and more convenient pickup.

Switching Costs

Digital grocers are taking a page out of the Costco playbook here. Consumers feel a sunk cost when they have paid for a membership causing them to direct a larger portion of their spend towards the company they are a member. In addition, digital channels do a great job of saving past order history and favorites. They store your credit card information and address. This decreases the likelihood of ordering from a competitor as long as the consumer is satisfied with the relationship. With less crossover of customers, there is also less crossover of consumer data allowing incumbents to become more entrenched. To the extent that companies differentiate their services, this also helps reduce customer turnover. For a customer that prioritizes flexibility in ordering from anywhere and getting it quickly, Instacart may be the preferred option. If you want your groceries to stay cold on the ride to your house, Kroger will gain priority. If you want to place many small orders and have them delivered straight to your refrigerator then WalMart is the obvious choice.

Network Effects

Instacart is likely trying to build a network effect, whereby the more customers it has the more attractive it will be for others to join. They would be able to negotiate better terms from retailers and pass savings along to their customers. However, I do not believe this will be successful as they are at a huge cost disadvantage to begin with and the largest grocers have a compelling case for customers to do business with them directly. In addition, Uber and DoorDash also have an army of gig workers they will likely use to eat into Instacart’s market share, especially in circumstances where they can use grocery delivery to maximize revenue per mile for their drivers.

As a reference point, Walmart enjoys a massive lead in overall grocery. Kroger has a pending deal to merge with #3 Albertsons.

USA Grocery Market Share, 2021

Conclusion

Digital grocery will continue to grow and become a larger part of the overall grocery market over time. Those best positioned to win have a combination of significant store assets, self-manufactured private label brands, reams of customer data, and scale. I believe WalMart and Kroger have the best combination of assets for the space and Amazon will have more success here than they have in traditional grocery due to their huge number of Prime members, but I suspect they will lose share over time due to less favorable pricing policies. Most regional grocers will struggle to compete in this transition due to lack of technology and scale. In my view, Instacart is not an attractive investment due to their lack of a defensible moat in the industry. Historically, freshness/quality and value have been the major determinants for buying behavior. Speed is a new variable introduced to grocery via delivery and key to the battle for consumers will be where speed ultimately settles in customer priorities relative to freshness/quality and value.

Holdings Disclaimer: At the time of this writing, our clients hold shares of (KR) Kroger in our Core Equity Portfolio and our Concentrated Equity Portfolio. This is not an offer or recommendation to buy or sell securities. We undertake no obligation to provide an update if/when our investment position changes.

Final Thoughts

At Aurora, we are constantly looking for attractive investment opportunities for our clients. We look for businesses with economic moats, quality balance sheets and attractive upside potential. This blog represents our thinking at the time of publication. If you are a DIY investor, use this only as a starting point for your research and be sure to do your own due diligence. For questions regarding our asset allocation and individual stock strategies, please reach out to us!

Invest Curiously,

Austin Crites, CFA

Austin Crites is the Chief Investment Officer of Aurora Asset Management, an Indianapolis-based subsidiary of Aurora Financial Strategies which is located in Kokomo, IN. He can be reached via email at austin@auroramgt.com. Investment Advisory Services are offered through BCGM Wealth Management, LLC, a SEC registered investment adviser. This blog does not constitute advice. This is not an offer to buy or sell securities. Advisor is not licensed in all states. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. BCGM Wealth Management, LLC manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results. Clients may own positions in the securities discussed.