Diamond Hill (DHIL): There’s Diamonds in Them Thar Hills

In the 1800’s as the California gold rush gained steam, Matthew Fleming Stephenson coined the phrase, “There’s gold in them thar hills” to remind people that California was not the only game in town. Today, it may be worth reminding folks that, as the masses flock to mega cap AI stocks, attractive opportunities exist to invest in highly profitable and overlooked businesses.

Diamond Hill represents an interesting opportunity for investors. The market capitalization as of 12/01/2025 is just $319.2M even as the company has more than $134M in corporate investments (excluding deferred comp) along with significant cash and no debt. On top of that, Diamond Hill has generated between $33M to $63M in free cash flow annually for the past 5 years that it uses to fund generous dividend and share repurchase programs. This company has a fortress balance sheet, and its enterprise value is just 3-5 times its typical free cash flow. It’s a cash cow.

Investors are sour on the stock because the flagship valuation-sensitive equity funds have struggled in the wake of an equity market environment that favors high growth businesses. However, we believe the market is missing some key details.

Significant liquid assets that should eventually be repurposed for new strategies and/or to fund special dividends and/or share repurchases

The fixed income business is booming

While the equity business has struggled, Diamond Hill maintains a strong reputation in the investment community that provides an opportunity to recover should markets shift away from growth strategies. At any rate, our analysis concludes that the stock is roughly fairly valued EXCLUDING its largest and most profitable business.

Business Summary

Diamond Hill is an investment firm based in Columbus, Ohio. The firm launched their large cap strategy (now managed by Austin Hawley) in 2002 managed by Chuck Bath, who came over to the firm from Nationwide. The fund surpassed $1B in assets in 2008 and the firm crossed the $10B mark in 2013. As of 10/31/2025, Diamond Hill manages roughly $30B in assets across equity, fixed income and long/short (L/S) strategies. These assets are primarily in mutual fund and separately managed account formats with about $8.7B in fixed income and $21.2B in equity and L/S strategies. Heather Brilliant has been the firm’s CEO since September of 2019.

Moat

The investment management business does not tend to benefit from formidable moats that can ensure excess profits far into the future. However, these types of businesses tend to sustain high levels of profitability and benefit from what we could call mini moats that are worth noting. DHIL averaged 27.02% return on invested capital for the 5-year period through 2024 for a reason.

Reputation/Track Record – Relationships with investors are critical to the success for the company. Many investors need to see long track records of investment performance and take years to become comfortable with a portfolio manager and parent company. Diamond Hill has a long track record of success in US equities and is quickly establishing one in fixed income. However, the past several years has been challenging for value-oriented investors (more on that later).

Scale/Distribution - Distribution is a serious challenge for investment managers. As firms grow larger, established distribution channels allow for faster scaling of new investment strategies thereby improving return on investment for the firm. I believe this has been critical to the growth of the fixed income business. Once an investment strategy reaches sufficient scale, it earns economic profits for the parent company.

Culture – This is probably the most important (but difficult to measure) aspect of an investment firm. Investment results and reputation can either be built or destroyed by a firm’s ability to organize around a set of values and get the most out of their talent.

The reason why I describe Diamond Hill’s moat as “mini” is that reputation can vanish quickly. Diamond Hill has done an excellent job to build and protect its reputation, which seems to be ingrained in the culture. I have met many people in the organization and believe that they have a significant advantage in hiring and cultivating a culture that prizes long-term investment results and client relationships.

Stakeholder Alignment

This is another area where the company excels. Every employee is aligned with shareholders through equity. Like most investment firms, employee compensation is largely variable which helps drive incentives and allows the business to enjoy relatively stable profit margins. Portfolio managers are incentivized through long-term investment performance rather than volatile shorter-term targets that can encourage destructive behavior. In addition, the company has a reputation for closing funds when they reach their capacity in order to protect the interests of existing clients. This runs counter to short-term profit incentives but is incredibly important for protecting the long-term value of the business.

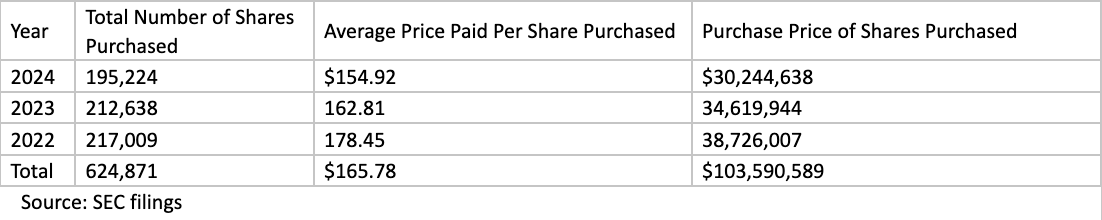

Probably the most attractive and concrete attribute is the company’s approach to capital allocation. Dividends and share buybacks have far exceeded share-based compensation. According to SEC filings, share-based compensation was about $10.7M in 2022, $11.7M in 2023 and $11.8M in 2024 totaling just over $34M for a 3-year period. By contrast, Diamond Hill repurchased more than $103M worth of stock during that same period. In addition, the company pays $1.50/share in quarterly dividends. They also issue special dividends when they have excess cash. From 2022-2024, the company paid almost $65M in dividends. The company will pay another $4/share special dividend on 12/05 of this year for shareholders of record on 11/21. Netting out share-based compensation, the company returned more than $134M to shareholders in the form of dividends and buybacks from 2022-2024. We expect this sort of activity to continue though the magnitude will vary depending on the success of the business. Through the end of Q3, DHIL had repurchased another 22,725 shares and had $35.2M left on their repurchase plan.

Share Repurchases

Dividends

Why Is the Stock Unloved/Ignored?

There are number of reasons why this stock is not popular with investors:

The Equity Business - Diamond Hill’s equity strategies have endured several years of client withdrawals. In short, equity markets have experienced a tremendous bifurcation in investment returns between growth and value-oriented philosophies. This last occurred in the late 90’s during the tech/telecom bubble. The equity market divergence coincided with the retirement of Chuck Bath. Though the transition to Austin Hawley was not a surprise, many investors use a manager change as a time to reconsider their options. The large cap fund, which holds about $15B out of $21B in equity assets (as of 10/31), was closed to new investors in 2022. It has since reopened but has seen steady outflows. All of the firms equity funds share the same investment philosophy and while some have performed better than others, it will be difficult to reverse the slide while investors favor allocations to growth funds. We do not believe this is a permanent impairment. The firm’s investment philosophy is sound, and Diamond Hill continues to supplement their team. However, for forecasting purposes, the future trajectory of the equity business appears to be the most important variable.

Actively Managed Mutual Funds Losing Market Share – Actively managed funds, especially in equity have been losing share to ETFs. More and more investors are allocating to passive investment vehicles through the likes of Vanguard and BlackRock. We expect this trend will likely continue, but will reach an equilibrium at some point. At any rate, active investing will need to survive in order to serve as a pricing mechanism. Diamond Hill is relatively small and should be able to maintain its niche so long as the firm can produce solid investment results.

No Coverage – No analyst estimates are available publicly. Companies of this size tend to not get much coverage on Wall Street, especially when they do not have a history of making acquisitions.

Valuation

Diamond Hill represents a significant bargain by our estimates. The easiest way to demonstrate it is by looking at the business in 3 pieces. The chart below illustrates how we think about the value of DHIL. While investors fret about the trajectory of the equity business, we believe the remaining assets are worth somewhere between $98.44 to $111.55 per share. This compares to a closing price of $116.03 on 12/01/2025. While the equity business has been shrinking and is the most difficult to value, we believe that it will recover in the long term and provide significant value. Even if the equity business continues to shrink, it will generate significant cash flow in the near term that can be used to fund dividends and share repurchases. Ultimately, we are left with a wide range of value, but liquid corporate investments anchor a stock that looks significantly undervalued. We think DHIL is likely worth between $129.11 and $222.44 per share.

Aurora Asset Management’ Estimates of DHIL Value

Corporate Investments – As of 09/30/2025, DHIL has $134.1M in corporate investments (excluding deferred comp) in their own investment strategies. This is used to “seed” strategies as a way of showing confidence as well as meeting strategy minimums set by various distribution platforms and clients. As strategies scale, these investments are typically liquidated and either used to seed new strategies or returned to shareholders through dividends and share repurchases. They also had a cash pile of $43.02M as of 09/30. All together, they have tangible book value (less the $14.9M special dividend on Dec 5th) of about $166M or $61.07/share which is largely liquid at the stated value. With about 2.72M shares outstanding, this equates to $61.07/share of value. While this value fluctuates with market prices, we believe it provides significant downside risk should the mutual fund business experience continued decline.

2. Fixed Income - The fixed income business has experienced tremendous growth in recent years. As of 10/31, the firm managed $8.7B in fixed income assets. The short duration securitized ($4.93B) and core fixed income ($3.62B) make up the majority of this franchise that attracted almost $2B in net inflows during the first 9 months of 2025. The company has launched several new strategies recently to continue the rapid expansion of this business. We project growth of between 10% and 20% for the next 5 years before settling in at 2% thereafter. We assume a 32% operating margin and 27% tax rate, which is typical for the firm and discount it at 10%. This leads us to an estimated value range of $101.57M-$137.21M or $37.37-$50.48 per share. While the fixed income franchise has been growing significantly faster than our estimates, this will eventually slow down and we want to leave a margin of safety.

3. Equity – Traditionally the strength of Diamond Hill (and still the majority of profits), the equity business has been losing assets. The first 9 months of 2025 saw over $3.1B in net outflows driven by large cap, mid cap and small-mid strategies (mostly large cap). We expect continued outflows in the short term due to poor investment performance relative to the benchmark. However, we believe that the outflows will eventually subside as markets shift. At any rate, bright spots remain as the long-short, international and micro-cap strategies have performed well. The international strategy has significant remaining capacity and could drive upside surprises with more traction. Given the wide range of reasonable possibilities here, we forecast somewhere between negative 25% and positive 5% annualized growth over the next 5 years and settling between -5% and 2% after that. The remaining assumptions (margin, tax rate, WACC) are the same as used for fixed income. For this segment, we arrive at a valuation range of $83.36M-$301.42M or $30.67-$110.89 per share.

Risks

While the corporate investments provide an anchor in our view, they could lose value should the funds provide negative returns. In addition, the fixed income growth story could prove short lived, especially if the firm’s strategies in asset backed securities stumble. The firm could also struggle to protect profitability if the outflows in the equity portfolios continue or even accelerate. In addition, shrinking asset levels could result in significant damage to the firm by leading to an exodus of talent. Should any or several of these risks materialize the true valuation may lie below the bottom point of our estimated ranges.

In Summary

We believe DHIL represents an attractive risk/reward opportunity at this juncture. This article represents our thoughts at the time of publication, and we may not update it as our analysis changes. Do your own due diligence and discuss any investment with your financial advisor prior to taking any action.

To learn more about our portfolios and approach, please reach out to us or visit www.auroramgt.com.

Invest Curiously,

Austin

Austin Crites, CFA

Chief Investment Officer

Aurora Asset Management/Aurora Financial Strategies