The Diversification Problem

Stock and Bond Markets May Move Together – Are Private Assets Really the Solution?

Blindsided. That’s how many investors felt in 2022. Yes, equity markets had a rough go of it as the S&P 500 produced a negative 18.11% return. No, I’m talking about the bond market. The one that’s supposed to provide ballast to a portfolio of otherwise volatile stocks. But something strange happened in 2022. The bond market, as measured by the Bloomberg US Aggregate Bond Index, declined by 13.01%. Fixed income provided little refuge.

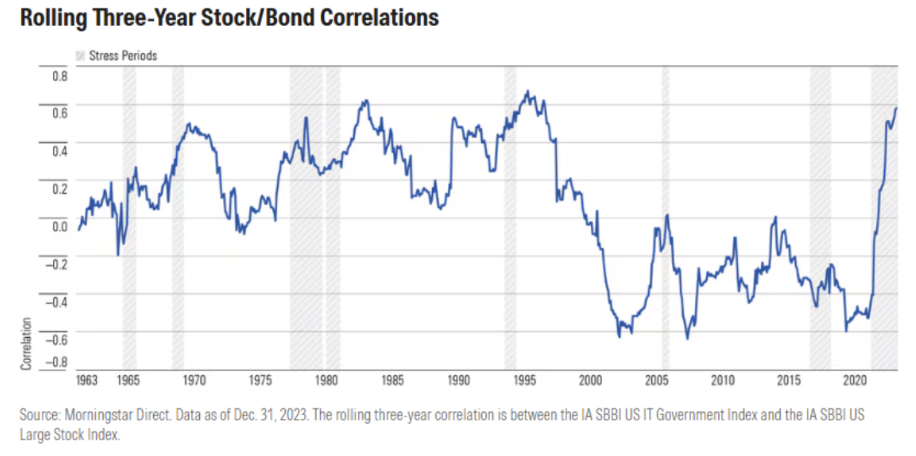

For decades, fixed income was negatively correlated to the stock market, providing excellent diversification to an equity portfolio. The chart below shows 3-year rolling stock/bond correlations over time. As I teach my students, relying on historical correlations can be dangerous, as they can change at any moment. It all comes down to the underlying rationale for the historical relationship. In the case of 2022, it was likely related to heightened worries about inflation coupled with relatively low yields. At any rate, the underlying problem is that bonds may decline in lockstep with your equity investments. So what should we do about it?

Are Private Markets a Solution?

I recently heard a presentation from an asset manager that proposed using private equity and private credit as a solution to this diversification problem. The logic goes that they exhibit lower volatility (as measured by standard deviations of returns) and that by including these assets we should have a more stable portfolio with better returns. Sign me up, right? HOWEVER....let’s untangle this one.

Volatility – The lower volatility statistics are a mirage coined by AQR’s Cliff Asness as Volatility Laundering. The assets are not regularly traded, and the asset manager has significant discretion in determining its value. They don’t change their mind on what it’s worth regularly, so the value on an investor’s monthly statement only changes periodically. It’s like the way we thought about the value of our homes before Zillow added price charts. The dollar amount we could sell for changes regularly depending on mortgage rates, the local economy, and consumer tastes. But unless we try to sell it, we can pretend it’s worth whatever we choose. The value is changing; we just don’t have precise data, so we get to pretend it isn’t real.

What are these assets? - Private equity and private credit are essentially stocks and bonds that don’t trade regularly. Private equity tends to have exposure to smaller (relative to public) companies with more leverage. Private credit is essentially adjustable-rate loans to smaller (relative to public) companies that can only borrow at higher interest rates. Essentially, these asset classes are similar to their public cousins but with a greater risk profile. Investors might be interested in these vehicles as a potential source of better returns so long as they believe they are receiving a discount on the assets to compensate for illiquidity. The problem is that the underlying economics of these investments remain similar to their publicly traded counterparts.

Are you kidding me?

So let me get this straight. My problem is that stocks and bonds are too correlated. And the solution is to buy more risky versions of each? That just doesn’t pass the sniff test. That’s why they gate investors on the way out. When their marks are significantly higher than the current value, you don’t get to sell.

Another Path

While I don’t buy the idea that drier kindling will help with my forest fire, the problem of diversification is still evident. Instead, I’d suggest some fire breaks. Better put, I believe investors should focus on diversifying their underlying sources of risk rather than owning similar vehicles in different wrappers.

Equity Markets – Technology companies dominate private and public markets. Roughly 35% of the S&P 500 is in the tech sector. By the time you add in names outside of “tech” like Amazon, Meta, Alphabet, Tesla, etc that trade like tech, half of the index has their fortunes tied together. Most of the venture capital industry is subsumed with AI.

Is this the way to build a diversified portfolio?

Contrary to popular belief, there’s a whole ‘nother world out there. The figure below is a 3-year correlation matrix by economic sector. Now, these relationships do change depending on what’s going on in the economy and in markets. But it does illustrate the benefits of true diversification. The energy sector is one of the better sources of diversification and is currently less than 3% of the S&P 500.

There are plenty of other options in the equity market to better diversify your risk, such as health care, defense stocks, mining, utilities, etc. These are very different types of businesses that thrive in different environments. Stock market indices are putting their eggs in one basket, but that doesn’t mean you have to do the same.

Bond Markets – The bond market is dominated in a different way, but by U.S. government Obligations rather than technology companies. The main source of risk there is that interest rate increases cause the value of those bonds to decline. There is also the risk of not being repaid (credit risk). Historically, we have glossed over that for the US Government, but given widening deficits over the years, we may someday test that assumption.

Private credit does have some selling points here in that the debt they offer is typically adjustable and not tied to the government. However, most that I’ve seen are heavily exposed to the technology sector, which doesn’t exactly provide much diversification for your equity investments, also tied to tech. In addition, a scenario where default rates increase would likely coincide with a poor economy and equity market. Aside from that, private credit has been very aggressive in raising capital from investors. I find many of the structures to be concerning (they do vary by vehicle), as investors sometimes are several layers removed from the borrowing entity. “I know the names of the companies we lend to” is a quote from one manager. Often, the debt has been passed like a hot potato through the value chain, and the product sold to the end investor is sufficiently opaque to get such a response when asked about the portfolio. I want more than the names. I want to know the financial condition of these borrowers, who their customers are, and what they do to make money (assuming they do make money). I’m sure there are some worthwhile offerings in the category, but what I’ve seen looks like a minefield.

This diversification problem within fixed income is a bit more difficult to solve, but I’m a firm believer that you should not increase your risk because interest rates are too low. As George S. Clason put it in The Richest Man in Babylon, “Gold flees the man who would force it to impossible earnings”. We have found some ways to diversify our risks, though. Merger arbitrage doesn’t offer massive returns, but you trade credit risk for the risk that a merger deal breaks. Catastrophe bonds can be volatile, but hurricanes and earthquakes are not impacted by interest rates or GDP growth.

In Summary

Prior to reaching for more exotic, expensive, and risky investment vehicles to solve the correlation problem of stock and bond markets, investors should consider tweaking the underlying nature of their current portfolio. After all, only you can prevent forest fires.To learn more about our portfolios and approach, please reach out to us or visit www.auroramgt.com

Invest Curiously,

Austin

Austin Crites, CFA

Chief Investment Officer

Aurora Asset Management/Aurora Financial Strategies

Austin Crites is the Chief Investment Officer of Aurora Asset Management, an Indianapolis-based subsidiary of Aurora Financial Strategies which is located in Kokomo, IN. He can be reached via email at austin@auroramgt.com. Investment Advisory Services are offered through BCGM Wealth Management, LLC, a SEC registered investment adviser. Registration with the United States Securities and Exchange Commission does not imply that BCGM or any of its principals or employees possesses a particular level of skill or training in the investment advisory business or any other business. This blog does not constitute advice. This is not an offer to buy or sell securities. Advisor is not licensed in all states. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. BCGM Wealth Management, LLC manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results. Clients may own positions in the securities discussed.